Fed Meeting Today: What Does it Signal for Cryptocurrency?

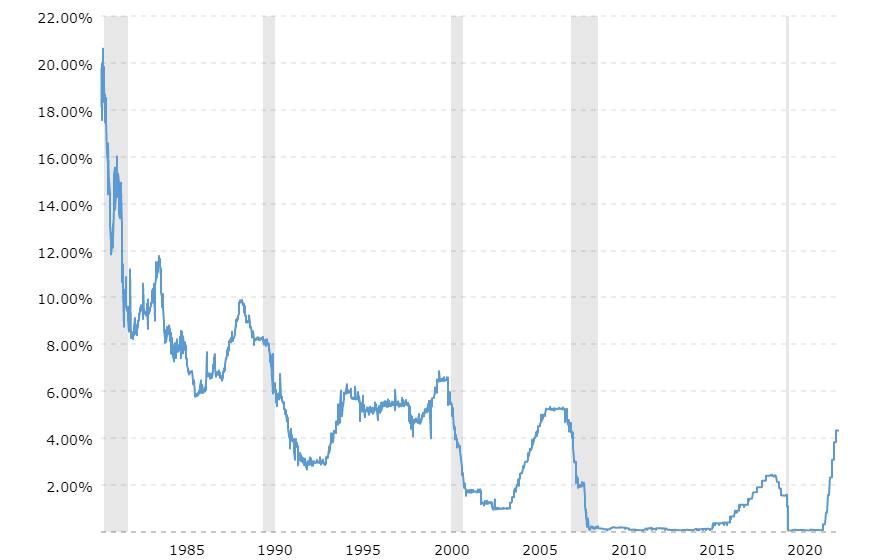

The Federal Reserve (Fed) is expected to ease interest rates by a quarter point (25 bps) today while indicating its ongoing commitment to combating inflation despite decreasing the size of rate hikes. The Federal Reserve’s eighth rate hike since March is scheduled for Wednesday and would bring the target for the fed funds rate to 4.50% to 4.75%. This is only a half percentage point away from the Fed’s projected final range of 5% to 5.25%.

The Fed must balance the risk of inflation and recession, as it navigates the consequences of its significant interest rate hikes in 2022. Although slowing monetary policy might appear to be a positive development, the Fed faces a difficult challenge in evaluating its impact.

What Does This Mean for Bitcoin and Crypto Markets?

When the Federal Reserve and other central banks increase interest rates, the money supply decreases, the Federal Reserve’s balance sheet shrinks, and costs for individuals and businesses to borrow rises. This leads to a decrease in consumer demand and valuations, resulting in lower asset prices. This also causes a shift away from riskier assets such as stocks and cryptocurrency, towards safer fixed-income investments such as bonds.

Although many anticipate a relatively calm meeting, it may be difficult for the Fed Chairman to control the market’s response. Investors have been optimistic as they believe the central bank will achieve a smooth economic landing and effectively curb inflation, leading to a shift back to easier monetary policies.

Silver Lining?

The Federal Reserve is not likely to wait for inflation to reach its target before lowering interest rates, based on recent trends. Since the early 1990s, when the 2% inflation objective was established, the Fed has consistently eased monetary policy despite inflation being higher than anticipated.

In the past, three of the most dramatic economic easing cycles happened when inflation was above 2%, so if history repeats itself, we may see the Fed pivot well before hitting its target 2% rate. That all depends on if the market reacts poorly and the Fed is forced to act, then the Fed more potentially start more Quantitative easing (QE) down the road and push the price of cryptocurrencies to new highs. This however, this is only a positive for asset prices, because QE is notorious for increasing the cost of living as well.