The Negative Impact of Quantitative Easing

The main objective of monetary policy in any economy is to maintain stability. Central banks, such as the Federal Reserve (Fed,) Bank of England (BoE,) and the Bank of Japan (BoJ) were established for this purpose. However, some argue that certain policies, such as quantitative easing (QE,) may ultimately undermine this goal. While these policies may provide short-term economic stimulus, they may also lead to monetary instability in the long run, negating the very purpose of monetary policies in the first place. This article will examine some of these criticisms of quantitative easing in more detail.

High Inflation

The central bank's aim is to keep inflation as low as possible, typically with a target of 2% to 3%, but QE has the opposite effect. QE increases the money supply by using new money to boost lending, which leads to inflation. There is limited data on the specific inflation caused by QE, as it is a relatively new policy, but evidence shows that it leads to asset inflation. This type of inflation has a negative impact on the cost of living. QE is often used in a struggling economy, where the initial effects of inflation can be positive, as it can stimulate growth, however when the economy recovers, it may become difficult to manage the later consequences of this stimulation. Therefore, QE can be seen as a temporary solution that addresses one problem but creates another in the long run, it is not a long term solution and can have negative consequences.

Interest rates

Like inflation, the central bank aims to control interest rates and use rate fluctuations as a means to “loosen” and “tighten” the economy. When the economy stabilizes, it fosters consumer confidence, which in turn leads to a strong economy. Conversely, if prices are unstable, consumers lose confidence, leading to a weakened economy due to delayed spending and reduced purchasing.

During QE interest rates are lowered, but this causes more inflation, which in response, central banks need to raise rates to counter this, thereby undermining financial stability. Therefore, QE tends to be a disruptive policy that has negative effects on the economy.

Business cycles

It can be argued that QE is a major contributor to worsened business cycles. QE creates an abundance of money in the economy, leading to lenders who are willing to take on more risk. This competition among lenders results in loans being given to individuals who would not have qualified for them. This leads to a boom, or expansionary phase, where businesses are growing and loans are easily accessible.

However, when QE ends, money becomes scarce, consumers may default and lenders are forced to call in their loans, leading to a contraction and a recession. Therefore, the same policy of QE that created the boom also caused the recession in the economy. It’s a perpetual cycle with no end game.

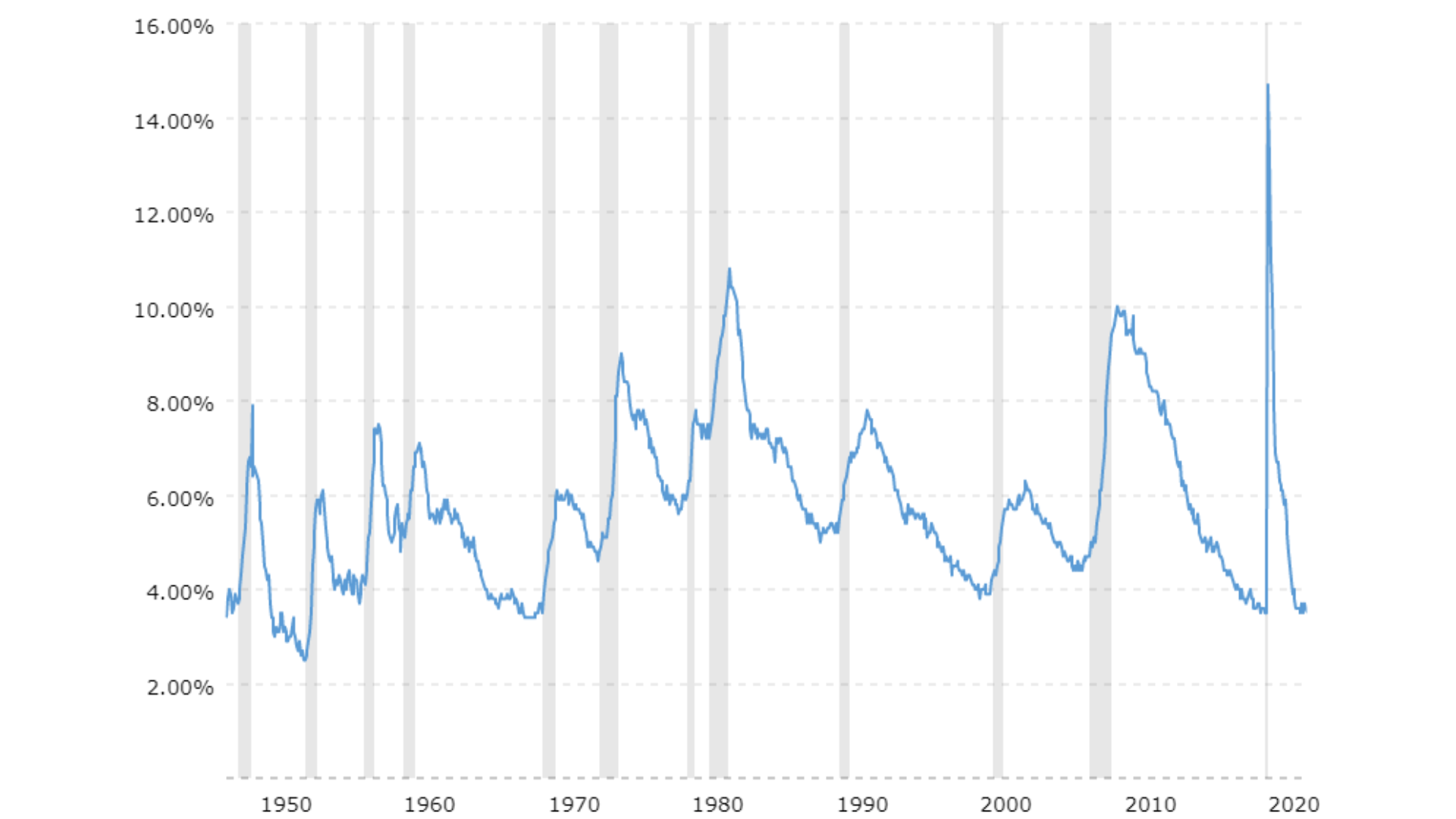

National unemployment rate from 1948 till 2022. Source: https://www.macrotrends.net/1316/us-national-unemployment-rate

Employment

Employment is closely linked with the business cycles. The boom phase witnesses massive creation of new employment. Banks lend easy money to businesses and they then use this money to expand, creating jobs in the process. Thus, the use of quantitative easing does create jobs in the short run. However, in the process the economy gets used to growing only after receiving monetary injections from the central bank. Therefore, as and when the bond buying stops so does the bank lending and businesses start to contract. It is a well known fact that as and when businesses contract, they reduce their overhead costs. As a result, people get fired and therefore employment levels plummet. Once again, quantitative easing was supposed to stabilize the employment rate. Instead it destabilized employment by causing volatility in the labor market.

Asset bubbles and inflation

An excess of money can lead to the formation of bubbles in asset markets. Higher salaries and profits tend to flow into these markets, causing the prices of assets to inflate. As the market, like the economy in general, becomes dependent on the continuous injection of monetary stimulus, when this stimulus stops, it leads to a large-scale withdrawal of money from the markets, causing prices to crash. This can lead to significant wealth transfers.

The theory behind quantitative easing is not well-proven and there are many differing opinions about its effectiveness. Some people believe it is extremely beneficial, while others believe it is dangerous and can have a detrimental effect on economies. The inflation we see today is caused directly from the QE used to counter the COVID-19 lockdown recession, so what do you think; Is it beneficial or detrimental?